That’s a Question That’s Going to Take Some Research

Have you ever noticed how stubborn people in construction are? From my experience they are some of the most headstrong and obstinate people you’ll ever meet. Why is that?

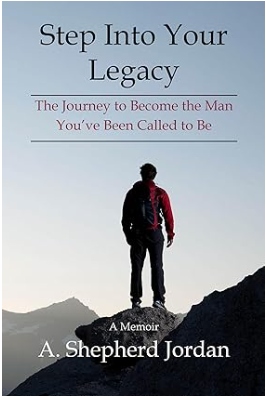

This past week in my mastermind we were discussing my friend Shep Jordan’s new book, Step Into Your Legacy. This book is about the importance of young men having good mentors and how good mentors are becoming more and more rare.

In this book, Shep takes you on his personal journey to manhood, guided and mentored by 6 remarkable men whose stories had a profound effect on his life.

Our mastermind discussion was about who the book should be targeted to. Young men who need a mentor or older men who need help with being a mentor?

Of course, the answer is both.

The problem with targeting young men is that many of them don’t think they need any help with anything, after all…they already know everything. This attitude might make it harder to get them to accept help.

This got me thinking…

People in construction are like those young men…they think they already know everything.

One of the recurring discussions I’ve had with people in the construction business over the years is about my business tools and systems. They would say how they need systems like I have. I’ve offered some of these tools to them, and the same thing always happens. NOTHING.

It’s like they are so bullheaded that they’re not willing to make any changes.

They know they need to make some changes, but just won’t.

So why is it that people working in construction are so bullheaded?

When you call someone bullheaded, you’re commenting on their obstinate nature, and maybe implying that they’re not very smart. Maybe you’ve seen bullheaded people act without thinking.

The word dates from the early 19th century, from the idea that a bull charges forward with strength and determination, but without any thought or contemplation.

It’s a little like a dog with a bone or a tennis ball. I know that when we’re throwing the tennis ball for our dog, and she brings it back she will not let go, no matter how long or hard you pull. This isn’t to her benefit, if she’d just let me have it, I would throw it for her again.

Hopefully, as humans we’re smarter than dogs and bulls.

I don’t think that it’s an issue of bullheaded people not being smart…maybe even the opposite.

After doing a little research, here are some traits of being stubborn.

We often think of being stubborn as a negative trait, but being a little hard-headed sometimes comes in handy. It helps you stand your ground and not give in to people out of peer pressure or guilt. It does pay to compromise in certain situations, but you also must know when to stand firm with people.

Here are seven traits of a bullheaded person –

- They have a strong will – They don’t hesitate to follow through with something they believe in. If they have a vision, they will accomplish their goals, come hellfire, or high water. This mental vigor pays off because you can’t reach your destination if you have fears about even leaving the driveway.

- They have resilience – They feel that they must do everything on their own. Nothing got handed to them in life, and they know if they want something, they will have to work for it. However, no challenge intimidates or scares away a stubborn person. They will work 16-hour days if they have to in order to accomplish their goals.

- They aren’t swayed because of peer pressure – They won’t cave just because no one agrees with them. They’ll make their points, have evidence to back them up, and stand their ground even if no one stands with them. While some people will just go with the herd because it feels comfortable, a person with pride doesn’t let the groupthink mentality affect them.

- They are passionate about life – They don’t like to back down from a challenge, they have a lot of passion and vigor for life. Nothing seems off-limits or impossible for them because of their willpower and determination to get things done.

- They have a good work ethic – They have high standards for themselves and enjoy getting the job done, no matter what it might entail. They typically do better working alone because of their sometimes combative nature, but if they can tone it down a notch, working in groups doesn’t present a problem. Having pride in one’s work only becomes a problem when people trample on others or don’t consider their opinions.

- They resist change – They often have a resistance to change because they like things the way they are. This inflexibility might just be their downfall. Life changes constantly, so having an open mind and a willingness to go with the flow can be a problem for stubborn people.

- They like to argue to prove a point – Not backing down in a discussion is one thing, but taking it too far sometimes means instigating arguments just for the sake of arguing. Stubborn people have an insatiable need to be right, and they see arguing as a fun pastime.

After looking over the research about stubborn people, I found that there’s more good than bad to being bullheaded. This research makes perfect sense why people in construction tend to be bullheaded. These traits are what are needed to fight daily construction battles.

The important thing is, if you are bullheaded, be aware and understand how to use it so that you don’t just keep charging ahead like a bull in a China shop. You need to be willing to make some changes when it would be good for your business.

Speaking of changes, if you or someone you know is in the construction business, we are currently offering our Business BUILDing Toolbox at a reduced Holiday price of $172. But don’t’ act like a dog with a bone because it’s going up $25 every week from now to the end of the year!

If you have questions about the Business BUILDing tools and how they can help you build the construction company of your dreams you can schedule a free 30-minute construction company consultation here.