One of the Tools You Should Have in Your Business BUILDing Toolbox

Last week I wrote about the importance of having savings, both individually and in business, and the high percentage of people who don’t. The tendency to spend everything you have is a problem when the unexpected happens. I’m not saying that after you pay the bills every dollar should be saved.

What I’m talking about is having money ready for big, planned purchases or unexpected emergencies.

This way you can use your own money and don’t have to pay someone else to use theirs.

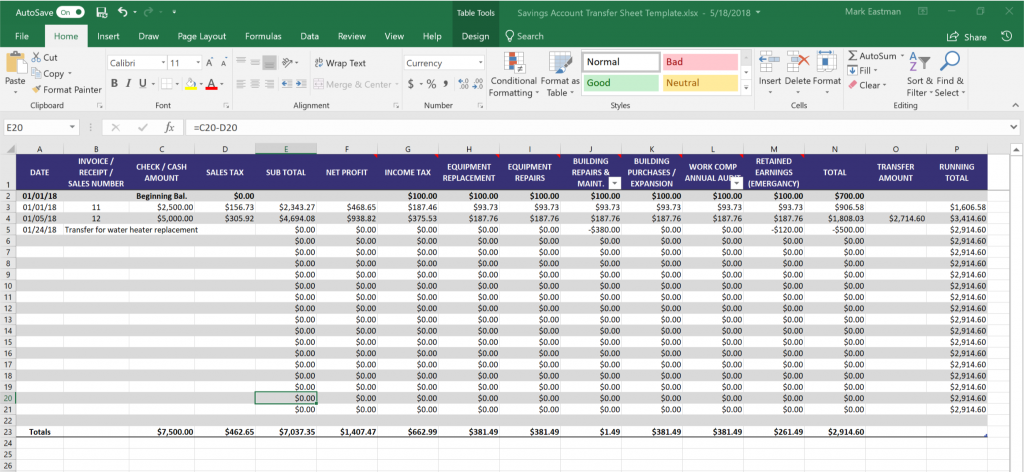

Last week I told you about the tool I use for this in my business, the Savings Transfer Sheet. This spreadsheet is easy to use and makes the process simple. What it doesn’t do is force you to save. If only there was just a way to hook peoples’ deposit tickets up to electricity so that they would get a shock when depositing money without saving.

The biggest problem with saving money is…not having a plan to do so. It can be overwhelming trying to figure out how much should be saved when depositing your revenue. One of the things that makes it hard is not having consistent amounts of income. If every week you deposited the same exact amount, you could decide once and always put aside a set amount for savings.

It’s rare in business that every job or every customer pays you the same amount every time you do business with them. There are some businesses like lawn mowing, hair cutting, pet boarding, etc. that a preset recurring price has been established, even so the number of recurrences each day or week is going to vary.

The purpose of this spreadsheet is to provide a simple accurate way to know how much to save every time.

As with most things, the most difficult part is the initial set up. This part requires some research, thought and time. Trust me…the time and effort will be worth it in the end.

- First – Look back through your financial records of the last several years. The more research you do the more accurate your understanding will be of your financial history. Even if you’ve only been in business for a short time, it will be a good place to start. This will let you see areas of unexpected expenses as well as dollar amounts.

- Second – Determine what things or areas that need to be saved for. Some examples of what these could be are:

- Repairing and/or replacing equipment

- Additional equipment or upgrades

- Repairing or replacing vehicles

- Large building repairs or maintenance items (HVAC, new roof, etc.)

- Building or facility upgrades, expansions, or purchases

- Taxes (income, property, sales, etc.)

- Irregular payments (bi-monthly, quarterly, annually, etc.)

- Retained earnings (money for emergencies…because they are going to happen)

- Third – Take the dollar amounts for each area that you have determined to be above or outside your normal operating costs. Figure out the percentage of your net revenue each one is. This gives you a place to start when setting up the “Savings Transfer Sheet” for the first time.

Building a “Rainy Day” savings is critical to the survival of your business.

It’s a cornerstone in the foundation of your business allowing it to weather the storms of life.

Next week we will dig deeper into the “Savings Transfer Sheet” and see how the information we’ve gathered fits into it.